Debenture Valuation

Debenture Valuation

A bond is an instrument of debt issued by a business house or a

government unit. The bonds may be issued at par, premium or discount. The par

value is the amount stated on the face of the bond. It states the amount the

firm borrows and promises to repay at the time of maturity.

The bonds carry a fixed rate of interest payable at fixed

intervals of time. The interest is calculated by multiplying the value of bonds

with the rate of interest.

Bond valuation is, generally, called debt valuation because the

features that distinguish bonds from other debts are primarily non-financial in

nature. Since bonds have a promised payment stream, they are less risky as

compared to the shares. But it does not mean that they are totally risk free.

Therefore, the required rate of return on a firm’s bond will

exceed the risk free interest rate but will be less than the required rate of

return on shares. The differences in required rates of return among bonds of

different companies are caused by differences in ‘default risk’. The value of

the bond depends upon the discount rate. It will decrease with every increase

in the discount rate.

For the purpose of valuation,

bonds may be classified into two categories:

(i) Bonds with a maturity period, and

(ii) Bonds in perpetuity.

ADVERTISEMENTS:

(i) Bonds with a Maturing

Period:

When the bonds have a definite maturity period, its valuation is

determined by considering the annual interest payments plus its maturity value.

The following formula can be

used to determine the value of a bond:

where, Vd = Value of bond or debt

R1, R2……. =Annual

interest (Rs.) in period 1, 2, …, and so on

Kd = Required rate of return

M = Maturity value of bond

n = Number of years to maturity.

It must be observed

from the above equation that as n becomes large, it becomes difficult to

calculate (1 + kd)n.

Symbolically:

Vd =(R)(ADFi, n) + (M)(DFi, n)

Illustration 1:

An investor is considering the purchase of a 8% Rs. 1,000 bond

redeemable after 5 years at par. The investor’s required rate of return is 10%.

What should he be willing to pay now to purchase the bond?

Solution:

Bonds Redeemable in

Installments:

A company may issue a bond or debenture to be redeemed

periodically. In such a case, principal amount is repaid partially each period

instead of a lump sum at maturity and hence cash outflows each period include

interest and principal. The amount of interest goes on decreasing each period

as it is calculated on the outstanding amount of bond/debenture.

The value of such a bond can be

calculated as below:

Illustration 2:

A company is proposing to issue a 5 year debenture of? 1,000

redeemable in equal installments at 14 percent rate of interest per annum. If

an investor has a minimum required rate of return of 12 per cent, calculate the

debenture’s present value for him. What should he be willing to pay now to

purchase the debenture?

Solution:

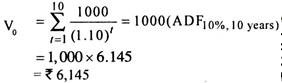

(ii) Bonds in Perpetuity:

Perpetuity bonds are the bonds which never mature or have

infinitive maturity period. Value of such bonds is simply the discounted value

of infinite streams of interest (cash) flows.

where, Vd = Value or bond or debt

Kd = Required rate of return

R1 = Interest at period 1

R2 = Interest at period 2

R = Annual Interest (as interest is constant)

Illustration 3:

Mr. A has a perpetual bond of the face value of Rs. 1,000. He

receives an interest of Rs. 60 annually. What would be its value if the

required rate of return is 10%?

Solution:

Vd = R/Kd

= 60/10

= Rs. 600

Relationship between the

Required Rate of Return and Coupon Interest Rate:

We have observed earlier that the value of a bond or debenture

is influenced by the coupon or fixed rate of interest payable on the bond and

the investor’s required or desired rate of return.

The relationship between the

required rate of return and the coupon interest rate can, thus, be summarised

as below:

(i) If the investor’s required rate of return and the coupon

interest rate are the same, the value of the debt (bond or debenture) shall be

equal to its face value or paid-up value, as the case may be.

(ii) If the required rate of return is higher than the interest

rate payable on bond or debenture, the value of the bond shall be lower than

its face or paid-up value.

(iii) If the required rate of return is lower than the interest

rate payable on bond or debenture, the value of the bond shall be higher than

its face or paid-up value.

The above relationship can be explained with the help of

following illustration.

Illustration 4:

Face value of a Debenture = Rs. 1,000

Annual Interest Rate of Debenture = 12%

Maturity Period = 5 years

What is the value of the

debenture, if:

(a) Required rate of return is 12%

(b) Required rate of return is 15%

(c) Required rate of return is 10%

Solution:

Vd = (R) (ADFi,n) + (M)(DFi,n)

Vd = 120(3.605) + 1000 (.567)

Or, Vd = 432.60 + 567

= Rs. 999.60 or say Rs. 1,000.

(b) Vd = 120 (3.352) + 1,000 (.497)

= 402.24 + 497

= Rs. 899.24

(c) Vd = 120 (3.791) + 1,000 (.621)

= 453.92 + 621

= Rs. 1075.92 or say Rs. 1076

Bond Values with Semi-Annual

Interest Rates:

We have so far determined the valuation of debentures

considering the annual interest payments for the sake of simplicity. However,

in most of the cases, interest is payable on semi-annual or half yearly basis.

To determine the value of such

bonds/debentures, the bond valuation equation has to be modified on the

following lines:

(1) The annual interest amount, R, should be divided by 2 to

find out the amount of half-yearly interest.

(2) The maturity period, n, should be multiplied with 2 to get

the number of half yearly periods.

(3) The required rate

of return, Kd, should be divided 2 to get an appropriate discount

rate applicable to half-yearly periods.

Thus, the basic bond valuation

equation as modified would be:

Illustration 5:

An investor holds a debenture of Rs. 100 carrying a coupon rate

of 12% p.a. The interest is payable half-yearly on 30th June and 31st December

every year. The maturity period of the debenture is 6 years and it is to be

redeemed at a premium of 10%. The investor’s required rate of return is 14%

p.a. Compute the value of the debenture.

Solution:

Vd = (R/2)(ADFi/2,2n) + M (DFi/2,2n)

12/2(7.943) + 110(.444)

47.658 + 48.840

Rs. 96.498 or say Rs. 96.50

Yield to Maturity or Bond’s

Internal/Rate of Return:

We have so far assumed that the investor’s required rate of

return, also called the discount rate, is given for calculating the value of

the bond/debenture. However, in many cases, we may be required to calculate the

required rate of return when the cash inflows and the current value/price of

the bond are given.

This rate also known as ‘yield

to maturity’ or ‘the internal rate of return’ for the bond can be calculated by

solving the following basic equation:

Vd = R1/(1 + kd)1 + R2/(1 + kd)2 + – – – Rn/(1 + kd)n

For example, suppose that the current value of a 8% debenture,

of Rs. 1,000 redeemable after 5 years at par, is Rs. 924.28.

The yield to maturity or the

internal rate of return can be calculated as below:

924.28 = 80/(1 + kd)1 + 80/(1 + kd)2 + 80/(1 + kd)3 + 80/(1 +kd)4 + 80/(1 + kd)5 + 1000/(1 +

kd)5

We can find the value

of kd equal to 10 percent from the above equation by

trying several values of Kd by hit and

trial method. At 10% the equation becomes:

= 80(3.791) + 1000(0.621)

= 303.28 + 621

= 924.28

However, the approximate value

of yield to maturity can also be found by using the following simple formula:

Ydm = I + (F-V)/n/0.4F + 0.6V

where, I = Annual interest payment

F = Face value of bond/debenture

V = Current value/price of bond

n = Number of years to maturity

Thus, in the above example, the

yield to maturity can be calculated as:

Ydm = 80 + (1000-924.28)/5)/(4/10 × 1000) + (6/10

× 924.28)

= 95.14/954.57

= 10% (appx.)

In case of perpetual or

irredeemable bonds/debentures, the yield to maturity can be calculated by using

the following simple equation:

Vd = R/kd or kd = R/Vd

where Vd = Value of debenture

R = Annual interest payment

kd = Required rate of return or yield to

maturity.

Illustration 6:

Mr. A has a perpetual bond of the face value of Rs. 1000. He

receives an interest of Rs. 60 annually. Its current value is Rs. 600. What is

the yield to maturity?

Solution:

Vd = R/kd

or kd = R/Vd

or kd = 60/600 = .10

Thus, the yield to maturity is 10%.

Valuation of Zero Coupon/Deep

Discount Bonds (DDBs/ZCBs):

The deep discount bond does not carry any interest but it is

sold by the issuer company at deep discount from its eventual maturity

(nominal) value. The Industrial Development Bank of India (IDBI) issued such

DDBs for the first time in the Indian capital market at a price of Rs. 2700

against the nominal value of Rs. 1,00,000 payable after 25 years.

Since there is no intermediate payment of interest between the

date of issue and the maturity date, these DDBs may also be called zero coupon

bonds (ZBBs).

The valuation of a deep discount bond can also be made in the

same manner as that of the ordinary bond or debenture. The only point to

remember is that there shall be only one cashflow at the time of maturity in

case of a deep discount bond.

Thus, the value of a DDB may be taken as equal to the present

value of this future cashflow discounted at the required rate of return of the

investor for number of years equal to the life of the bond.

The following formula can be

used to determine the value of a DDB:

Vddb = FV/(1+rn)

where Vddb = Value of a deep discount bond

FV = Face value of DDB payable at maturity

r = Required rate of return

n = Number of years to maturity/Life of DDB.

We can also make use of the present value tables to simplify our

calculations.

Symbolically:

Vddb = (FV) x (DFi,n)

Illustration 7:

A deep discount bond (DDB) is issued for a maturity period of 20

years and having a face value of Rs. 1,00,000. Find out the value of the DDB if

the required rate of return is 10%.

Solution:

Vddb = FV/(1+r)n = (FV) ×

(DFi,n)

= 1,00,000/(1 + .10)20

= (1,00,000) × (.14864)

= Rs. 14,864.

Doing the right exercises can be really helpful for growing taller. Swimming for example can help a lot to increase your growth potential.

ReplyDeletejeqing

My name is Fajar. I live in Bedono in Central Java I was in a very chronic financial issue and terminal health situation some few weeks back. After all my search for assistance from friends and neighbors proved abortive, I feel there was no one who truly cares. I became so exhausted due to lack of funds to expand my business and my 2 kids aged 5 and 8 were also not good looking due to lack of proper care as a result of finance. One faithful morning I saw an old time friend of my late husband and I told him all I have been going through and he said the only way he could help was to direct me to a good loan officer in USA that also helped him, He explained to me on how he was financially down and how he got boosted by this loan officer ( Mr Pedro who grant him 7,000,000.00 USD loan at an affordable rate of 2% rate . He further assured me that they were the only legit loan firm he found online. He gave me their email & That was how i applied and was also granted a loan and my life changed for the good. CONTACT THE ONLY GENUINE LENDER Mr Pedro VIA Email: pedroloanss@gmail.com to resolve your financial mess.

ReplyDeleteThis blog aware me about different programs which can become very useful for our friends and kids. Few websites provide combined courses and few of the are separately for single subject. Glad to get this information.Concept 3D Design Services

ReplyDeleteHow Mr Benjamin Lee service grant me a loan!!!

ReplyDeleteHello everyone, I'm Lea Paige Matteo from Zurich Switzerland and want to use this medium to express gratitude to Mr Benjamin service for fulfilling his promise by granting me a loan, I was stuck in a financial situation and needed to refinance and pay my bills as well as start up a Business. I tried seeking for loans from various loan firms both private and corporate organisations but never succeeded and most banks declined my credit request. But as God would have it, I was introduced by a friend named Lisa Rice to this funding service and undergone the due process of obtaining a loan from the company, to my greatest surprise within 5 working days just like my friend Lisa, I was also granted a loan of $216,000.00 So my advise to everyone who desires a loan, "if you must contact any firm with reference to securing a loan online with low interest rate of 1.9% rate and better repayment plans/schedule, please contact this funding service. Besides, he doesn't know that am doing this but due to the joy in me, I'm so happy and wish to let people know more about this great company whom truly give out loans, it is my prayer that GOD should bless them more as they put smiles on peoples faces. You can contact them via email on { 247officedept@gmail.com} or Text through Whatsapp +1-989 394 3740.